kennysarmy

Yeah but can your army do this?

- Messages

- 7,312

- Name

- Jeff

- Edit My Images

- No

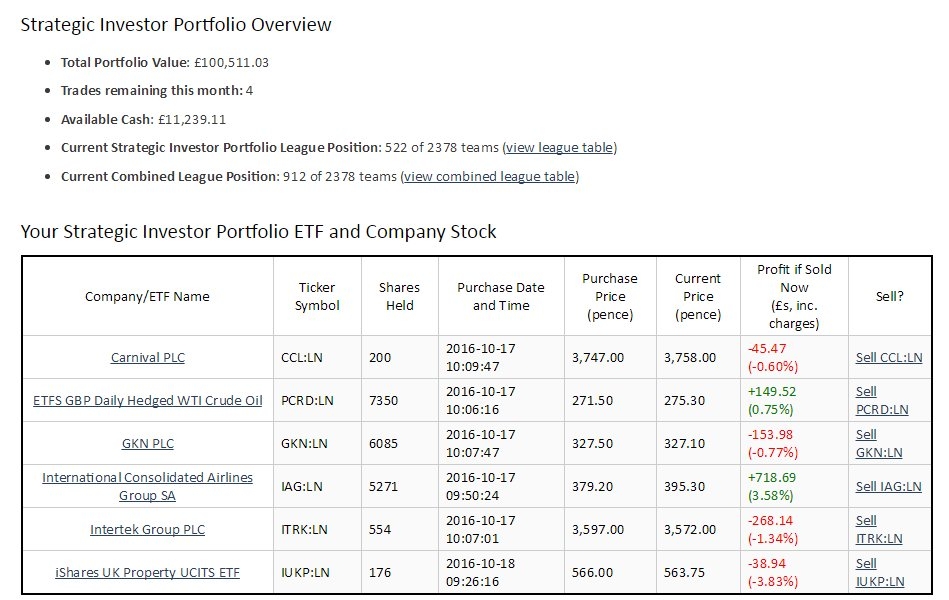

I'm entering a trading game at work that will run from next Monday (17th October) until 27th January 2017

I've got a virtual £100,000 to invest.

The rules are:

Basically I've no idea!

And wondered if there were any good websites out there that would give me good tips and advice in what to buy and sell?

Or feel free to drop any good tips down on this thread.

I'll keep you all posted how I'm doing.

Cheers

I've got a virtual £100,000 to invest.

The rules are:

Goal: to make as much money as possible by the end of The Trading Game!

Teams achieve this goal by buying and selling shares from the list provided. This list includes FTSE 100 companies, around 50 smaller companies called ‘SmallCap50’and Exchange Traded Funds (ETFs).

Teams will have the opportunity to run two share portfolios simultaneously. The first is the Active Investor portfolio. This portfolio is where teams will make their typical day to day trades, buying and selling shares each day. The second portfolio teams will manage will be the Strategic Investor portfolio. This presents more of a challenge to investors as only 10 trades per calendar month are allowed to be made, which will encourage investors to think more strategically when making investment decisions.

The rules:

Teams achieve this goal by buying and selling shares from the list provided. This list includes FTSE 100 companies, around 50 smaller companies called ‘SmallCap50’and Exchange Traded Funds (ETFs).

Teams will have the opportunity to run two share portfolios simultaneously. The first is the Active Investor portfolio. This portfolio is where teams will make their typical day to day trades, buying and selling shares each day. The second portfolio teams will manage will be the Strategic Investor portfolio. This presents more of a challenge to investors as only 10 trades per calendar month are allowed to be made, which will encourage investors to think more strategically when making investment decisions.

The rules:

- The minimum investment in a company’s shares is £1,000

- Teams can only trade between 09:00 and 16:30 each day that the stock market is open

- The maximum a team can invest in a company’ shares is 20% of the total value of their portfolio

- Teams should not hold more than £15,000 in cash, with the rest of the portfolio held in shares. If teams go over this they will be subject to Windfall Tax which is set at a rate of £1,000 for each day that more than £15,000 of cash is held, starting 8 days after a team’s first trade

- Teams can only make one trade in an individual company each day in their Active Investor portfolios

- Teams can only hold a maximum of 0.25% of the total shares available in one company

- Teams can only make 10 trades per calendar month on their Strategic Investor portfolios

Basically I've no idea!

And wondered if there were any good websites out there that would give me good tips and advice in what to buy and sell?

Or feel free to drop any good tips down on this thread.

I'll keep you all posted how I'm doing.

Cheers