and please use their services

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

eBay / HMRC clamping down on VAT evasion?

- Thread starter StewartR

- Start date

Not so much contradictory as ambiguous as I read it.Isn't that notification contradictory?

In the first line it says that the seller can't sell to UK buyers. Then it goes on to say .....so we have restricted their sales to UK buyers

Sales to UK buyers are restricted (i.e. limited items can be sold to UK buyers) rather than only UK buyers can purchase from them.

- Messages

- 12,662

- Edit My Images

- No

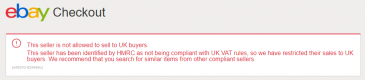

I tried to buy something on eBay today. UK-based seller, next-day delivery available so the item is clearly actually in the UK, VAT number confirmed on VIES as legitimate.

But then at the checkout I saw this:

View attachment 128230

Wow. Hooray. At last.

I just wonder if they will also apply this to EU buyers and EU suppliers, where clearly items are being shipped into the EU and somehow the local VAT/TVA/BTW is avoided

The last time I looked there seemed to be a few German suppliers and their prices were at a level where I suspect German VAT, (MwSt), had not been paid

- Messages

- 15,376

- Name

- Jeff

- Edit My Images

- No

Hmmm the shape of things to come .

- Messages

- 6,372

- Name

- Elliott

- Edit My Images

- No

Hmmm the shape of things to come .

Good. I know things may get a bit more expensive, but this country is loosing billions in unpaid revenue. This effects our NHS, public funding and local businesses.

- Messages

- 12,662

- Edit My Images

- No

I wonder what will happen when the UK has left the EU - buy stuff in Europe, Euro VAT paid and then bring it back into the UK - will UK VAT be then payable, with no deduction for say French TVA paid - I cannot see the French giving a refund at the border!!?

- Messages

- 7,954

- Name

- Chris

- Edit My Images

- Yes

I wonder what will happen when the UK has left the EU - buy stuff in Europe, Euro VAT paid and then bring it back into the UK - will UK VAT be then payable, with no deduction for say French TVA paid - I cannot see the French giving a refund at the border!!?

It'll be a shambles likely.

On the Ebay thing - remember not all business's need to be VAT registered, only if sales will exceed a certain threshold (£85k a year currently I believe)

- Messages

- 15,376

- Name

- Jeff

- Edit My Images

- No

It would also help if Stewart told us the name of the actual seller

- Messages

- 11,513

- Name

- Stewart

- Edit My Images

- Yes

Why?It would also help if Stewart told us the name of the actual seller

- Messages

- 15,376

- Name

- Jeff

- Edit My Images

- No

Saves us the hassle of buying something then finding you can’t

- Messages

- 11,513

- Name

- Stewart

- Edit My Images

- Yes

There are over 25,000,000 sellers on eBay. What are the odds that (a) you want to buy something from this particular seller, and (b) this particular seller is the only one that has been restricted by HMRC?Saves us the hassle of buying something then finding you can’t

Last edited: