ChrisR

I'm a well known grump...

- Messages

- 11,026

- Name

- Chris

- Edit My Images

- Yes

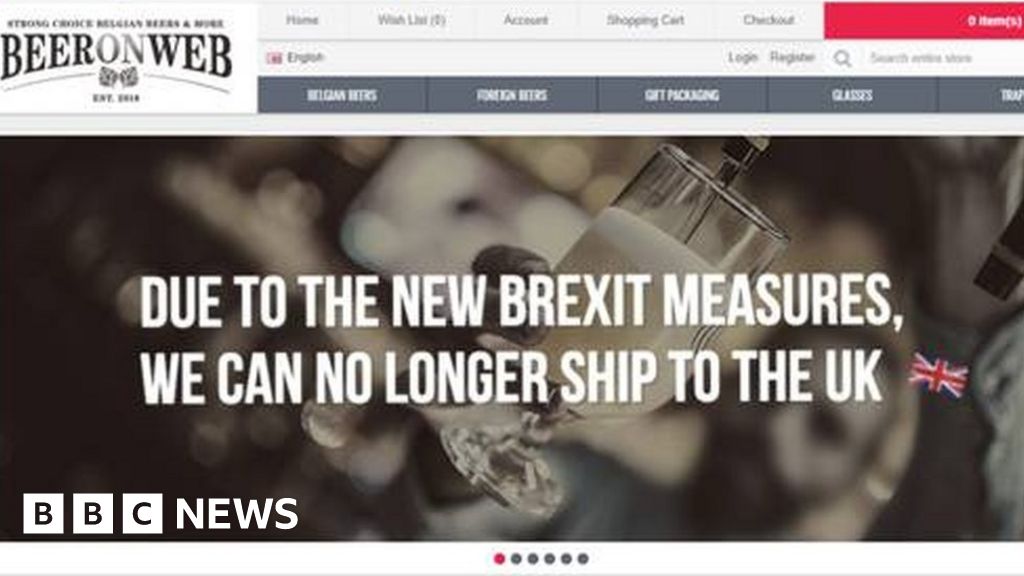

Now that we're emerging from our 40+ years of confinement and can see the sunlit uplands ahead, free of red tape, I'm left wondering what happens if we buy used film gear (cameras, lenses, etc etc) from Europe? I understand we won't have to pay duty, but will we have to pay VAT?

I saw that Paul from Analogue Wonderland is doing a software modification so he can supply films to European countries VAT free; he said each country has different rules about when VAT would apply. And apparently the EU will shortly bring in a new rule that VAT wouldn't be charged on imports under €150. But both of those are going the other way.

Anyone know?

PS I queued for ages yesterday to buy as many Large Letter stamps as I could afford before they went up, while someone ahead laboriously wrote out their Customs Declaration for their parcel going to Europe. So much more enjoyable than the old way!

I saw that Paul from Analogue Wonderland is doing a software modification so he can supply films to European countries VAT free; he said each country has different rules about when VAT would apply. And apparently the EU will shortly bring in a new rule that VAT wouldn't be charged on imports under €150. But both of those are going the other way.

Anyone know?

PS I queued for ages yesterday to buy as many Large Letter stamps as I could afford before they went up, while someone ahead laboriously wrote out their Customs Declaration for their parcel going to Europe. So much more enjoyable than the old way!